The Future of Live Events and Sports

Update #27 — July 23, 2021

We are excited to return with our 27th update to the “Future of Live Events & Sports: The Re-Emergence of Fans Post Covid-19”. We continue to closely track how our framework for understanding Fan Demand is impacted based on market-specific factors, venue initiatives, and fan avidity. We have sifted through all the noisy data to bring you insights on how live events and sports will be different because of the COVID-19 pandemic.

In this update, we explore:

- Market fluctuations across KAGR Fan Demand Index while surges in the Delta Variant pose threat to previously lifted restrictions

- Strong overall attendance and sell-through for 2021 NBA and NHL playoffs with minor setbacks in markets most impacted by the pandemic

- A 12% decrease in average MLB attendance from 2019 to 2021

- A new dataset integrated to better understand fan interests beyond whether they have purchased a ticket indicating potential changes in fan demographics

Market Analysis

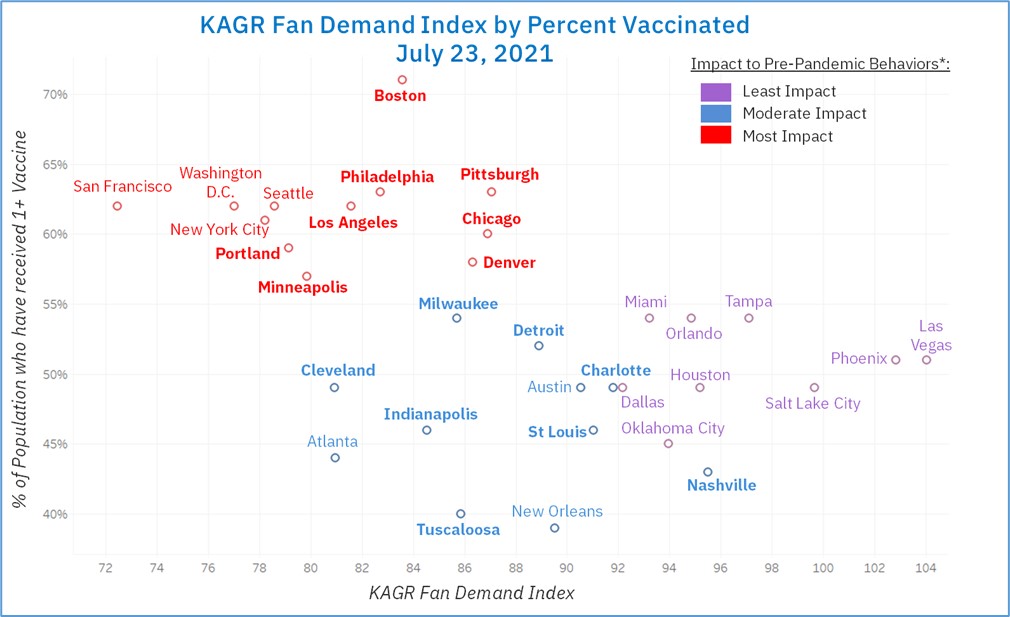

The KAGR Fan Demand Index remained flat (<1%) over the last month; with a few markets experiencing large fluctuations. Tuscaloosa (-15%), Indianapolis (-12%), and Cleveland (-11%) saw meaningful setbacks while Austin (+11%) jumped up significantly. Consumer behaviors also remained flat with the largest increase seen in Washington D.C. (+15%). COVID-19 cases are down 30% on average, with the Delta Variant representing 83% of all new cases and several markets including St. Louis (+125%), Los Angeles (+100%), and New Orleans (100%) have seen concerning trends. Despite this concern, cases are still down 90% since its peak in December 2020. 53% of the eligible market population are currently vaccinated with at least one shot, up 9.5% from early June.

As daily activities return, we examine the impact of the pandemic on market indicators from pre-pandemic levels. This week we saw 50% of the markets move market groupings. Specific market highlights include:

- Eight markets fell back to the Most Impact grouping including Pittsburgh and Philadelphia. Both markets saw decreases in economic mobility (-6% for Pittsburgh and -4% for Philadelphia) and consumer behaviors (-2%). Minneapolis also fell back, dropping 3.5% in Fan Demand Index, with a sharp 12% decrease in dining and entertainment activity.

- Eight markets also fell back to Moderate Impact from Least Impact. Tuscaloosa saw the largest drop in Fan Demand Index (-15%) with recent COVID-19 cases rising 50%. In addition, dining and entertainment activity dropped 17% and airport travel decreased 14%.

- Cleveland and St. Louis also fell back to Moderate Impact. In Cleveland, dining and entertainment activity dropped 26% and economic mobility fell back 5%. In St. Louis recent confirmed COVID-19 cases spiked (+125%) with dining and entertainment activity dropping 34%.

Tracking Attendance & Sell-through

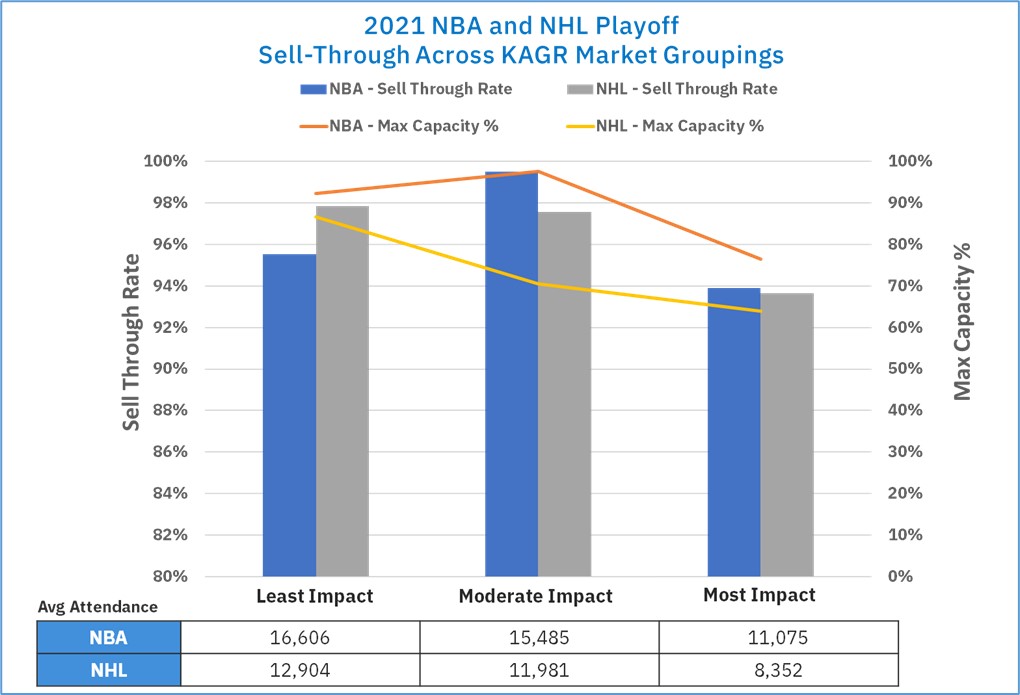

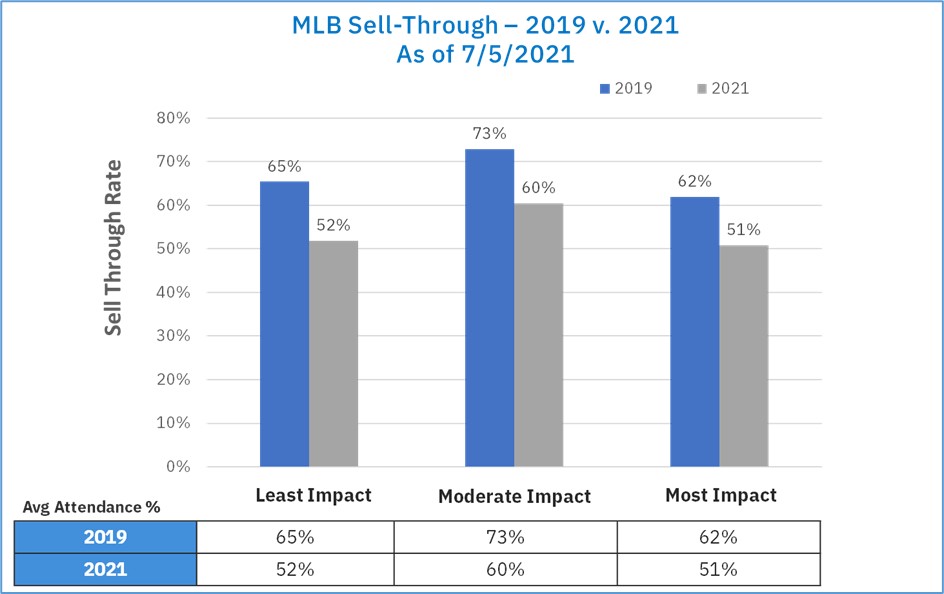

This week we examine sell-through for the 2021 NBA and NHL playoffs across relevant markets. We also compare sell-through and attendance for the MLB between the 2019 and 2021 season.

- The NBA enjoyed larger attendance and higher max capacities than NHL teams across all markets. Several NHL teams took a more moderate approach to capacity restrictions including the Washington Capitals (27%) and Minnesota Wild (25%) which kept their capacity far below the minimum seen by the NBA (Los Angeles Lakers had 45% capacity in the first round).

- Sell-through rates in Most Impacted markets across both leagues were overall lower than other market groups. In previous Future of Live Events and Sports issues, we saw higher sell-through when capacity restrictions were more limiting. As capacities level off, we expect greater relative impact to fan demand and sell-through in Most Impacted markets.

- The Moderate Impact grouping for the NBA consisted of the Atlanta Hawks and Milwaukee Bucks; both teams had strong runs in the playoffs with Milwaukee taking it all this week. Sell-through for both markets were up 4% over those Least Impact markets and 5.6% better than those Most Impacted.

- As of July 5th, all MLB teams have moved to 100% capacity. On average, sell-through is down 12% from 2019 to 2021. Contrary to market and economic indicators, markets within the Least Impact group saw the largest decrease on sell-through (-14%).

- The most impacted clubs include the Arizona Diamondbacks (-53%), Seattle Mariners (-39%), and the New York Mets (-29%).

- Three MLB clubs saw a positive impact in 2021 compared to 2019 including Texas Rangers (+10%), San Francisco Giants (+10%), and Miami Marlins (+2%).

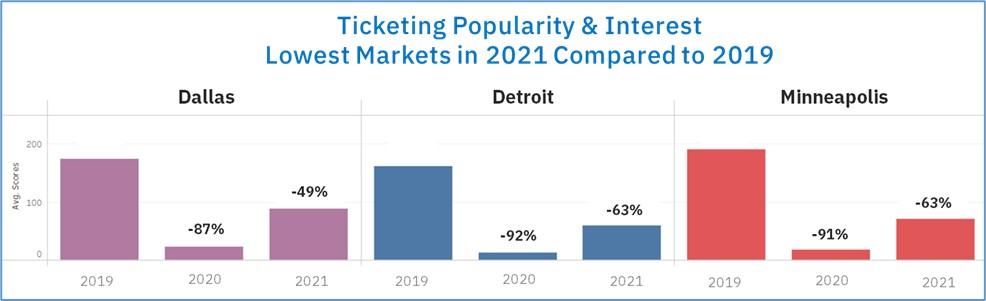

Sports Popularity & Interest Across Markets

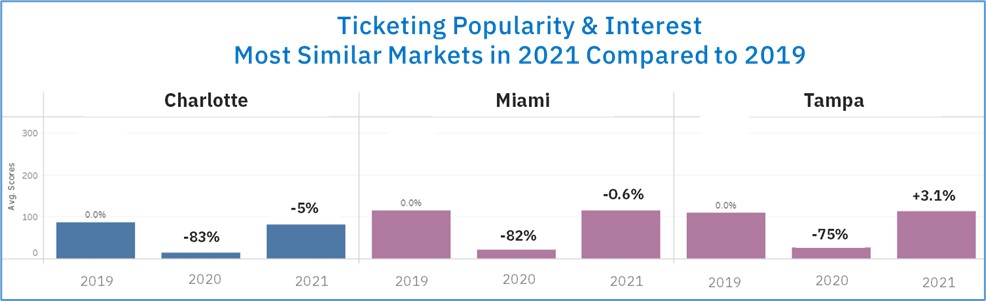

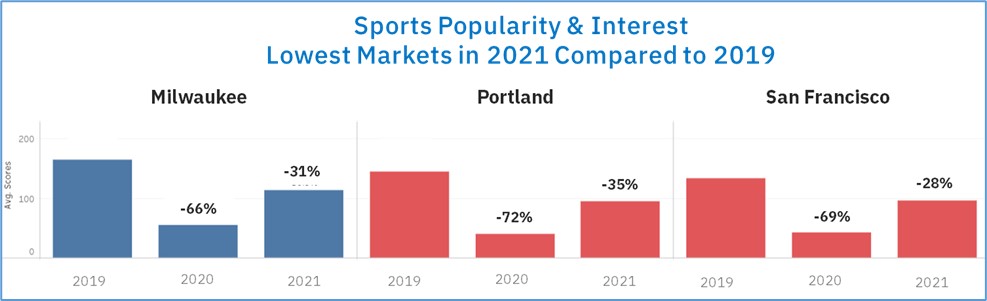

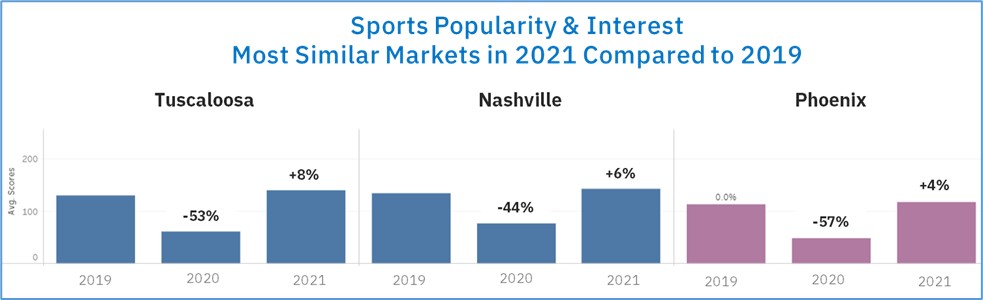

This week we feature a new dataset to better understand fan interests beyond whether they have purchased a ticket or attended an event. We believe this information combined with other market indicators provides a deeper understanding of overall impact and may indicate potential changes in fan demographics.

In the visuals below, we examine high level categories across live event tickets and sports. We look at which markets have the lowest general ticket and sports interest compared to 2019 and markets where ticket and sports interest are greater than those of 2019.

SUMMARY

With COVID-19 cases rising in several markets, we will continue to track and monitor fan demand, behaviors, and interest with a goal to measure market impact. In the coming updates, we will dive deeper into specific markets and leagues and how KAGR Fan Demand Index combined with attendance and general interests can be used to inform business and fan specific strategies for teams, leagues, and industry players.

To subscribe for future updates, please sign up here: https://www.kagr.com/futureofsportsandevents/