The Future of Live Events and Sports

Update #29 — August 31, 2021

In our 29th update to the “Future of Live Events & Sports: The Re-Emergence of Fans Post Covid-19”, we closely monitor rising COVID-19 cases. We continue to track how our framework for understanding Fan Demand is impacted based on market-specific factors, venue initiatives, and fan avidity. We have sifted through all the noisy data to bring you insights on how live events and sports will be different because of the COVID-19 pandemic.

In this update, we explore:

- Our largest week-over-week drop in KAGR Fan Demand Index as COVID-19 cases soar and consumer and economic indicators drop back

- Sell-through trends for MLS and potential implications for upcoming fall events

- Fan trends including college football demand, mobile ticketing warning signs, and vaccination requirements for live events

Market Analysis

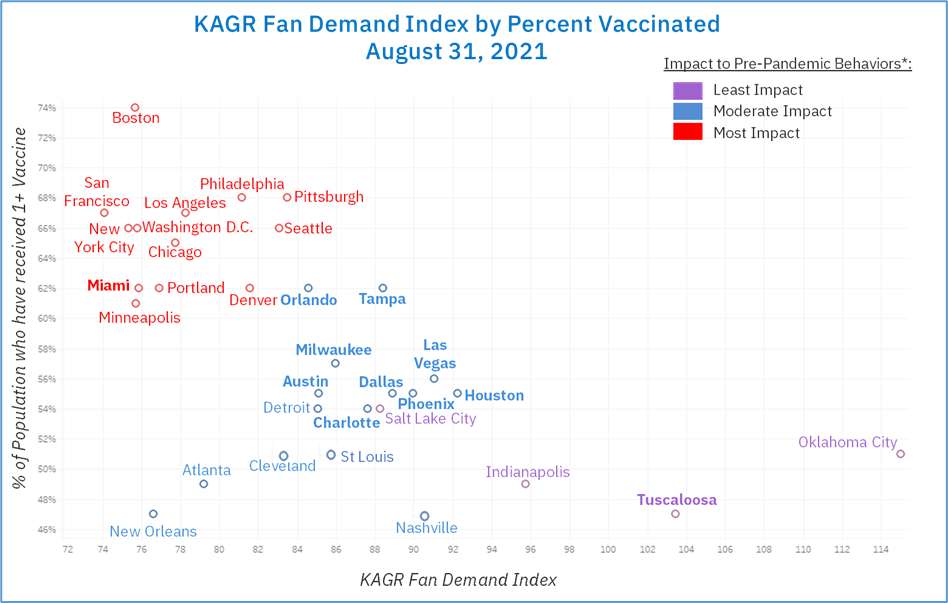

The KAGR Fan Demand Index meaningfully dropped back (-12%) over the last three weeks with several markets experiencing large decreases. Of note, New Orleans (-29%), Los Angeles (-20%), and Miami (-18%) saw significant setbacks while Seattle (+18%) was one of the few markets to see KAGR Fan Demand Index rise. Recent confirmed COVID-19 cases surged 68% on average (+24% in hospitalizations) with several markets including Minneapolis (+175%), Washington D.C. (+150%), and Indianapolis (+150%) far above. The average percent positive COVID-19 cases also jumped to 10.5% (up 25%) and is in line with levels from January 2021. The eligible market population currently vaccinated (with at least one shot) is up another 4.9% to a total of 58% vaccinated over the last three weeks.

Consumer and economic indicators experienced meaningful setbacks this week. A recent study comparing July/August 2021 with the same period in 2019 shows a dramatic change (30-40% drop) after behaviors were close to on par in early July. More specifically over the last three weeks our analysis shows:

- a 4% decrease in air travel (largest decrease in Dallas, -12%)

- a 2% decrease in dining and entertainment activity (largest decrease in Los Angeles, -39%)

- a 1% decrease in consumer behaviors (largest decrease in New Orleans, -10%)

With the large drop in KAGR Fan Demand Index and the continued surge in COVID-19 cases and hospitalizations, we examine the impact of the pandemic on go-forward fan demand and behaviors. This week eleven markets experienced meaningful change; specific highlights include:

* KAGR Fan Demand index uses a variety of market data including COVID-19 factors, economic indicators, and other consumer behavior information. Impact to Pre-Pandemic Behaviors is defined as percent change of market indicators from pre-pandemic levels.

- 9 markets jumped back to the Moderate Impact group (from Least Impact including Austin, Charlotte, Dallas, Houston, Las Vegas, Milwaukee, Orlando, Phoenix, and Tampa):

- Charlotte and Las Vegas experienced the greatest increase in recent confirmed COVID-19 cases (115% and 85% respectively)

- Austin and Charlotte saw the greatest decrease in dining and entertainment activity (-22% and -19% respectively)

- Milwaukee saw the largest drop in economic mobility[1] (-15%)

- Miami fell back to Most Impact from Moderate Impact; recent confirmed COVID-19 cases increased to 55% to 11.5 cases per capita (the highest among all markets). Dining and entertainment activity fell 23% and air travel decreased 9% from three weeks ago.

- Tuscaloosa was the only market to see positive movement, shifting to the Least Impact grouping this week from Moderate Impact. Tuscaloosa experienced the greatest increase in consumer behaviors (+7%) and dining and entertainment activity (+13%).

[1] A measure of economic activity using consumer shopping behavior and visits to businesses

Fan Avidity at a Glance

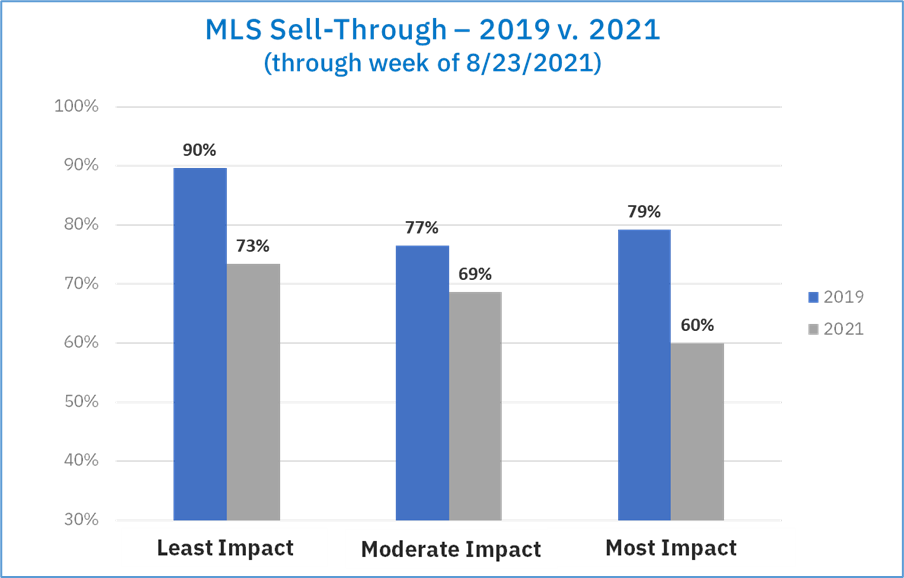

This week we examine sell-through for the MLS, comparing 2019 to 2021 across relevant markets. MLS has seen a substantial increase in interest post-pandemic; with viewership up 50% from 2020 on ESPN and both MLS and NWSL seen as targets for new and established sports owners and investment groups. While a handful of traditionally strong MLS markets maintain sell-through on pace with 2019, several markets have seen a setback.

- Overall, 2021 sell-through is down 15% across KAGR analyzed markets (this excludes Kansas City, three clubs that did not operate in 2019 – Austin, Miami, and Nashville – and three Canadian based clubs)

- Three traditionally high clubs (with 100% sell-through across the 2019 season) maintain strong 2021 numbers: Los Angeles FC (0% change), Portland Timbers (-7%), and Seattle Sounders (-14%).

- The largest season-over-season sell-through decrease was seen by New York FC (-81%), New York Red Bulls (-56%), and Los Angeles Galaxy (-33%). All three of these clubs are part of the Most Impact market grouping, contributing greatly to the 24% drop seen this season. If we remove these clubs, the Most Impact grouping sell-through is 69%.

Even with the rise of soccer’s popularity in the United States and increased engagement through several tournaments this summer including the Olympics, Gold Cup, and European Championship, the 2021 MLS sell-through data continues to demonstrate a decrease in demand for attending live events. This decrease is on par to what we saw for the NBA and NHL this spring and early summer (e.g., NBA Playoff sell-through was down 12% from 2019). We will be watching closely as the NFL returns next week – while early ticket sales and secondary activity is strong, it remains to be seen whether this downward sell-through trend perpetuates especially in the face of rising COVID-19 concerns.

Other Fan Trends:

- Early 2021 College Football demand on the secondary market shows signs of being on par with 2019 performance:

- Alabama, Penn State, and Michigan rank as the three most in demand teams this season and the first time in 10 years that Alabama was the highest selling team. Tuscaloosa has consistently been amongst our Least Impact group throughout our analysis.

- Of note, week 1 demand is being driven off two of the neutral site games being played in Charlotte and Atlanta. Both markets have consistently ranked in the Moderate to Least Impact group however have experienced some setbacks in recent weeks with COVID-19 cases on the rise and consumer behavior activity falling back. We will monitor how those markets recover and what impact, if any, it has to college football fans this weekend.

- Mobile ticketing warning signs from the English Premier League:

- Mobile ticketing will continue to be put to the test – especially where it is being introduced for the first time at some NFL stadiums this fall. In the opening two weeks of the English Premier League, several challenges arose, including a report of fans waiting up to 20 seconds after the person in front of them scanned to do the same with 10% of fans missing kickoff. The result is that several clubs have opted for a more flexible approach, despite the COVID-19 safety concerns. In Everton, only one-third of their 31,000 season ticket members have opted for a digital ticket.

- Proof of vaccination for entry – many venues and artists are enacting vaccination specific protocols for fans starting this fall:

- The Toronto Raptors, Maple Leafs, and Toronto FC will initiate a vaccination requirement for all fans starting mid-September.

- Coachella producer AEG will require proof of vaccination for all owned and operated events starting October 1st. A negative COVID-19 test will not be a substitute and only with necessary documentation will medical or religious exemptions be considered.

- Live Nation will also follow suit, requiring either proof of vaccination or a negative COVID-19 test. Several artists are also imposing additional restrictions – for example, the Killers are requiring both vaccination and a negative COVID-19 test along with a face mask.

Fan demand shows a concerning trend as we head into the start of the NFL, NBA, and NHL season. With prior season capacity restrictions lifted, the true impact of the pandemic for fans will be on display. Assuming less fans are in stands, digital channels and products will be even more critical for leagues and teams, not only for the 2021 season but for engagement going forward.