The Future of Live Events and Sports

Update #30 — September 20, 2021

In our 30th update to the “Future of Live Events & Sports: The Re-Emergence of Fans Post Covid-19”, we continue to track how our framework for understanding Fan Demand is impacted based on market-specific factors, venue initiatives, and fan avidity. We have sifted through all the noisy data to bring you insights on how live events and sports will be different because of the COVID-19 pandemic.

- A stabilization in KAGR Fan Demand Index as recent confirmed cases and consumer behaviors level out after late summer drops

- Full stadium sell-through and attendance trends across leagues

- Fan preference concerning vaccine requirements

Market Analysis

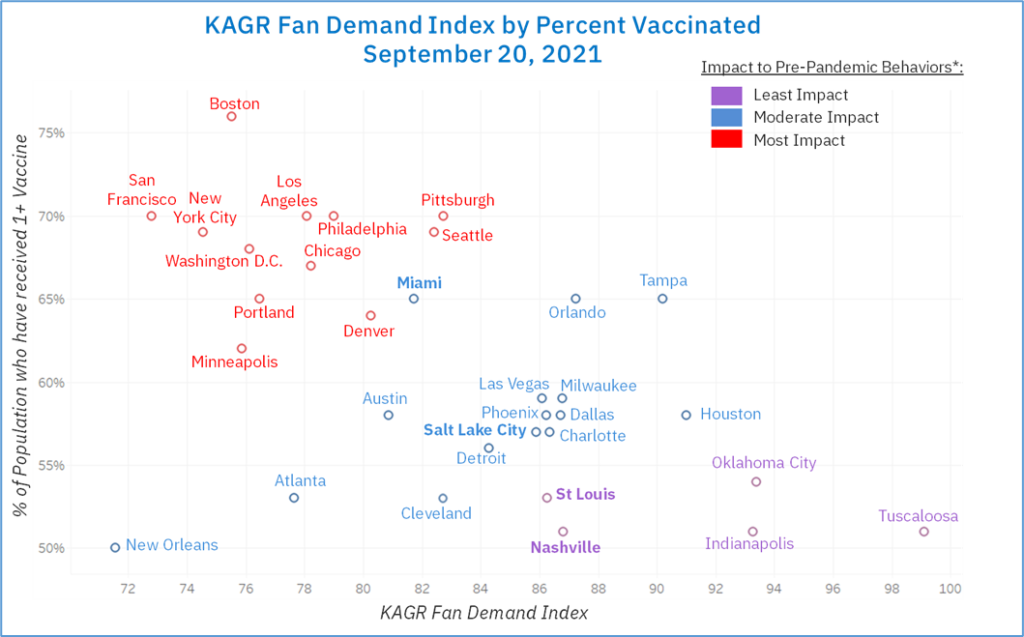

On average, recent confirmed COVID-19 increased slightly (+2%) with several markets including Cleveland (+122%), Pittsburgh (+75%), and Philadelphia (+75%) seeing numbers far above. New Orleans saw the largest decrease in recent confirmed COVID-19 cases (-54%) over the last two weeks. The eligible market population currently vaccinated (with at least one shot) is up another 4.6% to a total of 61% vaccinated (52% of the population has two shots).

We continue to examine the impact of the pandemic on go-forward fan demand and behaviors. This week four markets experienced meaningful change; specific highlights include:

- 2 markets jumped up to the Least Impact group (from Moderate Impact including Cleveland, Nashville, and St. Louis):

- Nashville saw an 11% increase in dining and entertainment activity

- St. Louis experienced a meaningful drop in recent confirmed COVID-19 cases (-23%) and saw a 11% increase in dining and entertainment activity

- Miami jumped back to Moderate Impact this week (after one week at Most Impact) as recent confirmed cases dropped 43% (6.6 cases per capita) and dining and entertainment activity soared 66%.

- Salt Lake City also moved up to Moderate Impact; recent confirmed COVID-19 cases experienced a small relative increase (+29%) with Percent Positive Tests decreasing 10% (now at 8.9 per capita).

Fan Avidity at a Glance

Fan comfort continues to shift as COVID-19 cases and precautions fluctuate across markets. In a Morning Consult study this month, 42% of sports fans indicate comfort to attend a game, down from a peak of 55% in early July 2021. Despite the 23% drop over the past two months, comfort levels are significantly above those in September 2020 (where 19% of sports fans were comfortable attending a game).

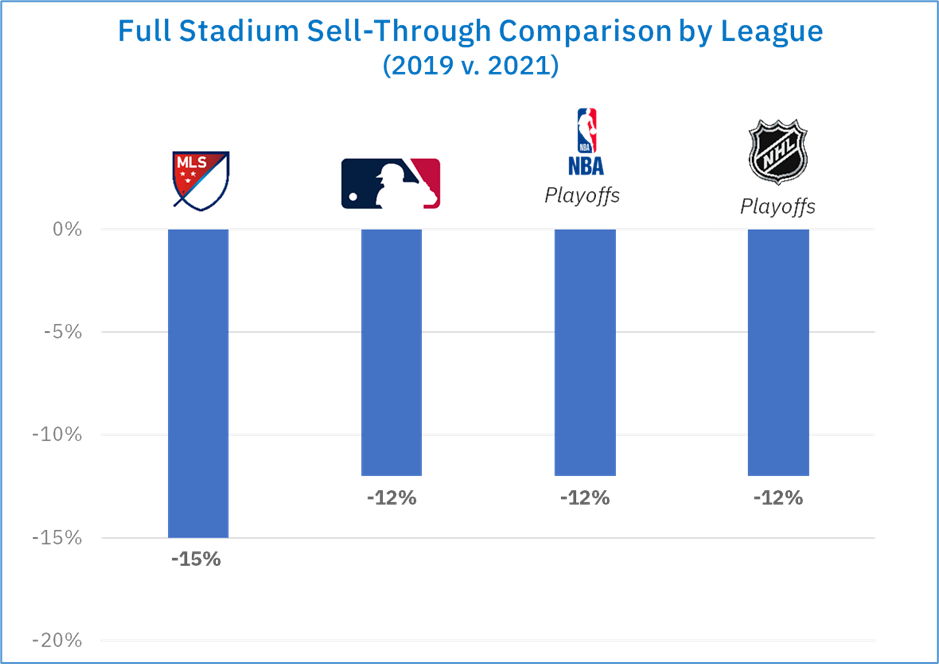

We continue to collect and analyze publicly available data on sell-through and attendance across leagues. The impact of fan demand and public sentiment is palpable when looking across professional leagues this past spring and summer. Overall, full stadium sell-through is down 12%-15% across MLS, MLB, NBA (Playoffs), and NHL (Playoffs).

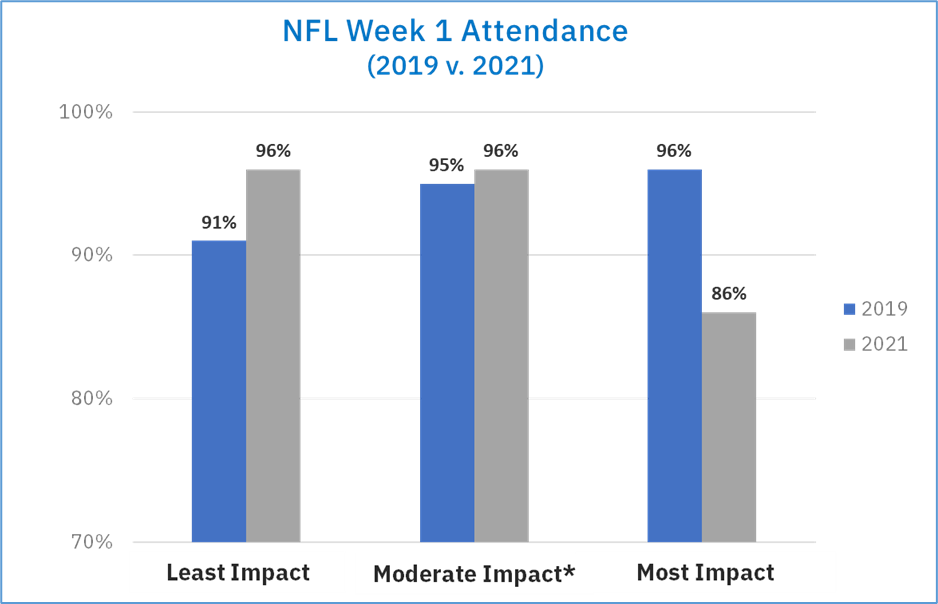

As the NFL season is now in full swing, Week 1 Attendance numbers show fluctuations across all KAGR market groupings, down 1% on average. The Least and Moderate Impact markets show minor increases while Most Impacted markets experience the largest gap.

Source: https://www.sports-reference.com/

- The Most Impact markets saw the greatest drop (-10%) in attendance from 2019. These markets include Los Angeles, Boston, New York City, and Washington D.C. Greatly contributing to this change are the Los Angeles Rams (-12%) and Washington Football Team (-30%).

- The Least Impact markets saw the biggest jump from 2019 (+5%), largely driven by Tampa Bay Buccaneers (+20%). The Atlanta Falcons (-8%) and Houston Texans (-4%) were among two markets in this group to see a decline in this year’s week 1.

Sports Betting Soars in NFL Week 1

While attendance remains below pre-pandemic levels, engagement in sports betting has shown no signs of slowing, setting multiple records in NFL Week 1:

- 58.2 million online sports betting transactions were recorded in the U.S., a 126% increase year-over-year

- New Jersey reported the highest volume of transactions (12.5 million)

- Nevada’s sports betting handle experienced a 20% increase year-over-year for the four days

Tracking Vaccination Requirements

As the impact of vaccination requirements is being closely monitored, a recent poll of 2200 adults (of which 552 are regular NFL game attendees), indicate a preference for these requirements:

- 54% of regular NFL game attendees are more interested in going to a game if all fans were required to present proof of vaccination

- 40% of NFL fans in general would be more interested

- Only 19% of both regular NFL attendees and NFL fans would be less interested

- Interestingly, 65% of regular NFL attendees and NFL fans were vaccinated indicating some indifference to the requirement even though they are vaccinated themselves

SUMMARY

As KAGR Fan Demand stabilizes and vaccine requirements are introduced and enforced, we will be tracking the impact on sell-through and attendance heading into the fall. While in-person demand is likely to be impacted for some time, sportsbook and digital engagement continue to demonstrate significant growth. Leagues and teams have a critical opportunity to better capture and identify customers through mobile ticketing, sport betting, and other digital offers. Smart and nimble activation strategies will allow organizations to react to changing fan behaviors in the months to come.